Regulatory Alert: Panel recommendations propose rollback of new CSR rules

19 August 2019

Background:

In July 2019, the Rajya Sabha passed the Companies (Amendment) Bill, 2019 aimed at bringing ease of doing business, bring in a robust framework through which the Companies Act can be implemented.

Among other major changes, the parliament also cleared amendments to the companies law that will tighten norms pertaining to CSR spending for corporates.

Highlights of Amendments applicable for CSR-Section 135: The following are the key highlights of the CSR spend related amendment cleared in the parliament:

|

Sub-Section

|

Existing Provision

|

Post-Amendment (July 2019)

|

Interpretation

|

|

sub-section (5)

|

The Board of every company referred to in sub-section (1),shall ensure that the company spends, in every financial year, at least two per cent of the average net profits of the company made during the three immediately preceding financial years, in pursuance of its Corporate Social Responsibility Policy

|

The Board of every company referred to in sub-section (1),shall ensure that the company spends, in every financial year, at least two per cent of the average net profits of the company made during the three immediately preceding financial years or where the company has not completed the period of three financial years since its incorporation, during such immediately preceding financial years, in pursuance of its Corporate Social Responsibility Policy

|

Gives clarity that all companies eligible for CSR spend will be considered irrespective of whether they have been in existence for minimum 3 years period or not

|

|

sub-section (5)

|

If the company fails to spend such amount, the Board shall, in its report made under clause (o) of sub-section (3) of section 134, specify the reasons for not spending the amount

|

If the company fails to spend such amount, the Board shall, in its report made under clause (o) of sub-section (3) of section 134, specify the reasons for not spending the amount and, unless the unspent amount relates to any ongoing project referred to in sub-section (6), transfer such unspent amount to a Fund specified in Schedule VII, within a period of six months of the expiry of the financial year

|

The amendment mandates that the unspent amount should now be transferred to a Fund specified in Schedule VII (which includes activities which may be included by companies in their CSR Policies) latest within 6 months of the financial year ending. This will ensure that a separate fund is created for the purpose of CSR activities.

|

|

sub-section (6): New

|

Not present in earlier provision

|

Any amount remaining unspent under sub-section (5), pursuant to any ongoing project, fulfilling such conditions as may be prescribed, undertaken by a company in persuance of its Corporate Social Responsibility Policy, shall be transferred by the company within a period of thirty days from the end of the financial year to a special account to be opened by the company in that behalf for that financial year in any scheduled bank to be called the Unspent Corporate

Social Responsibility Account, and such amount shall be spent by the company in pursuance of its obligation towards the Corporate Social Responsibility Policy within a period of three financial years from the date of such transfer, failing which, the company shall transfer the same to a Fund specified in Schedule VII, within a period of thirty days from the date of completion of the third financial year.

|

Defines the type of account and the timeline that needs to be considered while transferring the unspent amount reserved for CSR activities

|

|

sub-section (7): New

|

Not present in earlier provision

|

If a company contravenes the provisions of sub-section (5) or sub-section (6), the company shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to twenty-five lakh rupees and every officer of such company who is in default shall be punishable with imprisonment for a term which may extend to three years or with fine which shall not be less than fifty thousand rupees but which may extend to five lakh rupees, or with both.

|

Lays down the provision for heavy financial penalty and / or imprisonment if the company fails to adhere to the mandatory CSR spend provisions specified in subsections 5 and 6.

|

Implications and demand for roll-back:

The above amendments including the newly added sub-section (7) which attracts heavy penalty as well as possible imprisonment have drawn sharp criticism from the corporate sector in India. Hence it was proposed by the newly formed CSR high-level committee to regard CSR violations as civil offences with financial penalty instead of imprisonment for the executives of the defaulting company.

On 14th Aug 2019, following the recommendations of the abovementioned high-level CSR committee, the Government has agreed not to go ahead with the imprisonment penalty among other.

Following is a summary of the key impacting recommendations by the CSR panel committee headed by corporate affairs secretary Injeti Srinivas:

- CSR violations should be regarded as civil offences that are liable to monetary penalties

- CSR spending should be eligible for tax deductions and companies be allowed to carry forward unspent balances foxr three-to-five years.

- Banks and limited liability partnerships also to be covered by a mandatory CSR expenditure framework.

- For companies having CSR spend less than Rs. 50 lakh, proposed exemption from constituting a CSR committee

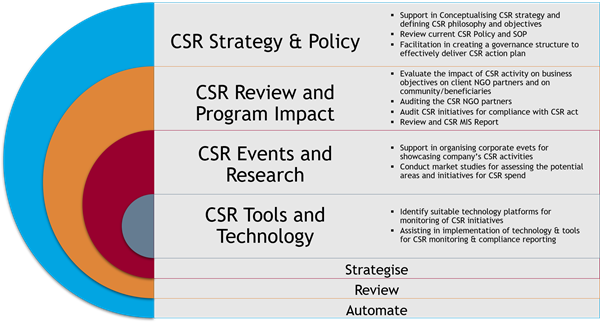

BDO CSR Advisory Services: Targeting benefits from CSR Strategy to Impact Assessment