INDIAN

TIFFIN

The economic fallout in a time dominated by rising oil prices and accelerated by the ongoing Russia-Ukraine war (which is showing no signs of abatement) continues to reverberate quite strongly in the Indian economy, which is powered by imported oil.

The economic fallout in a time dominated by rising oil prices and accelerated by the ongoing Russia-Ukraine war (which is showing no signs of abatement) continues to reverberate quite strongly in the Indian economy, which is powered by imported oil.

The Reserve Bank of India (RBI), India's central bank, lowered its GDP growth forecast to 7%, attributing the decline to the headwinds from geopolitical tensions, tightening global financial conditions, and slowing external demand. In a double disappointment for the economy, retail inflation hit 7% in August, reversing three months of decline, while industrial growth slumped to a four-month low of 2.4% in July down from 12.7% in June. The current account deficit (CAD) in April-June was USD 23.9bn, much higher than the USD 13.4bn in January-March 2022. A clear downslide when compared to the current account surplus of USD 6.6bn in April-June 2021.

After a buoyant spell that lasted a few years, with a peak forex reserve of USD 635bn in September 2021, the reserves are down to USD 545.65bn. The current reserves are estimated to be enough for nine months of imports, a benchmark cover that was 15 months of imports a year ago.

On the trade front, the forex bleeding continues, with India's exports contracting 1.2% in August from a year ago, the first decline since November 2020; a consequence of the slowdown in the developed world that negatively impacted trade in India. Unsurprisingly, the imports continued to grow at a fast clip, widening the trade deficit to USD 28.7bn, though it was down from the record USD 31bn in July 2022. Meanwhile, exports shrank to USD 33bn in August 2022, with the overall trade deficit for the fiscal year (April-March 2023) likely to be USD 160-180bn.

India's foreign trade policy, which was last updated in 2015, was supposed to have a tenure of five years, until 2020. However, the new policy release has been postponed several times, with the latest postponement announced for another six months. Over the last couple of years, two critical rollouts, Atmanirbhar Bharat (self-reliant India) and Production-Linked Incentive (PLI), lack clarity regarding its long-term continuity. The PLI scheme was introduced to reduce the dependence on China. However, whether the PLI scheme is a temporary bridging mechanism, an export promotion system, or an investment promotion scheme needs to be defined.

After an approximately ten-year hiatus, India is on a spree of negotiations - negotiating and executing Free Trade Agreements (FTA). Earlier this year, FTAs with Australia and UAE were completed. Presently, FTAs with the UK, EU, and Canada are under negotiations, and it is widely expected that the India-UK FTA will be executed well before the end of October 2022. In 2019, India backed out of the Regional Comprehensive Economic Partnership (RCEP), which included China, Japan, Korea, Australia, and several other countries in the East fearing a Chinese import onslaught. Presently, in 2022, US President Joe Biden initiated a new Indo-Pacific Economic Framework (IPEF) that includes 14 countries and represents 40% of the global GDP and 28% of the global goods and services trade. However, India has yet to decide whether it would accede to the Framework that may expose its agricultural sector to market forces. Moreover, it is debatable whether the FTAs are beneficial as the earlier FTAs with Japan, Korea and ASEAN countries seemed detrimental to the interests of Indian businesses.

On another front, the Indian rupee is experiencing a high magnitude of turbulence against the dollar, with the Indian currency depreciating by 9.2% in 2022. Conventionally, the exporters stand to gain, but the overall economic impact may not be positive as the exports contain a high import content. However, while economies across the globe are pruning their growth forecasts, the Indian Government seems confident about its prospects. For instance, the latest monthly report by the Ministry of Finance argued that while slowing growth and higher inflation are affecting significant economies, growth in India has been robust, and inflation is under control on the back of a strong domestic economy.

As the northern hemisphere enters a long winter with a squeeze on gas supply enforced by Russia, India too prepares to cope with high inflation exacerbated by fuel prices. Still, it hopes to deliver a decent economic performance in a downward currency spiral.

Between 30 July 2022 to 29 September 2022, around 69 M&A deals were announced of which 38 M&A deals were closed. The aggregate value of deals announced is USD 6,982.56mn dominated by 52 domestic deals (USD 5221.09mn) followed by 17 cross-border deals (USD 1761.47mn).

In terms of sectors (considering only closed deals), the Information Technology sector saw deals worth USD 32.97mn followed by the Consumer Discretionary sector with deals worth USD 14.22mn and the Consumer Staples sector with deals worth USD 6.39mn.

‘Outsourcing’ as a concept has come a long way since it began in the 1990s.initially outsourcing models were largely adopted to leverage the labour arbitrage and bring bottom line savings; the trend has now evolved to provide value addition. With an increasing number of processes being outsourced, it required the service provider to establish a Centre of Excellence (CoE) to bring in industry and process expertise.

CoEs were established for technology, industry and business processes. These CoEs largely work as cost centres and are responsible for bringing in expertise and to support sales and delivery. Although, the term CoE came in much later, the concept and thought process started much earlier-on, with service providers rendering providing managed services support, that later progressed to companies setting up their own captives or outsourcing units within the region. Once the outsourcing journey began, service providers were able to move these capabilities to nearshore and offshore locations.

Today, based on the offerings most outsourcing players have CoEs for Manufacturing, Banking, Capital Markets, Technologies (Microsoft, Cloud, AI, etc.) and functions like Taxation and more.

CoEs are now providing best practices, building tools for automation, developing training programs for the organisation and supporting the transition from sales to delivery.

As technology evolved over a period, so did the trends; from CoEs to a combination of onshore, nearshore and offshore models have helped build global teams with greater emphasis on the follow-the-sun model. Nearshore capabilities give businesses the flexibility of not only time zones but also, an advantage of local language and knowledge. For example, LATAM has become a key region to support customers in EMEA where Spanish and Portuguese are required.

Evolution in technology has enabled businesses to move their data and applications from on-premise to cloud models thereby, helping in providing access to teams remotely.

With the push of Artificial Intelligence (AI), Robotic Process Automation (RPA) and Bots, businesses across the industry are expecting service providers to bring automation to repeatable and transactional processes. RPA and Bots can execute tasks 24/7 using defined SOPs and built-in AI. This ensures an increase in productivity and a decrease in headcount that enables the organisation to diversify its effort into other work areas which can give greater financial benefit to the business. Sales/Purchase Order Processing and Accounts Receivable/Payable are good candidates. Service providers who would continue to rely on manpower centric approach would not be able to sell the proposition.

The pandemic created the urgency for enabling access to data from anywhere, through secure means. Securing PII information, storage, and access to organisation data for processing and handling, made outsourcing service providers build robust mechanisms to comply with local regulations.

Service providers are hence building alliances with companies with niche capabilities and are seamlessly integrating their products and services into their offerings. Businesses expect service providers to be agile and responsive to manage disruptions and become an advisor for the customer.

The role of consulting with outsourcing will intertwine even more as businesses demand end-to-end support; consultants being the SME and large outsourcing players bringing in the technology and managed services to meet future-centric needs. Whether in a captive or outsourced third-party set-up, the challenges remain common and the status quo ante shall no longer keep businesses ready for the challenges of the next decades to come.

Upskilling workforce would remain a key agenda for service providers as the demand for a generic workforce would taper over a period. Niche and skilled resources will ensure productivity and help meet the needs of a demanding environment.

Outsourcing has been around for a long time – Accenture started in 1991 and there were other first movers, particularly in the banking industry that established the norm for what would form an important boon of the Indian economy (and others like the Philippines, China, etc.). The concept has helped accelerate globalisation and the cultural integration of the West and East. Over the last many years, the industry has continued to mature and make rapid strides and has morphed from a “your mess for less” to a centre of excellence built on an intelligent and ambitious workforce.

Transformation and the need to be on the technological edge has led to a revolution in how companies and business leaders leverage service providers in this domain. Particularly in the last four to five years, the realisation has dawned that technology-led transformation brings returns faster and enhances the digital quotient of any enterprise to help it drive revenue and growth. And more recently, the Pandemic has changed the way business leaders think about this. Accenture's research across CxOs showed what’s concerning them:

Availability of real-time data, composed analytics and actionable insights is becoming critical to running large global operations which were not born digital.

The pace of change in the business environment has increased the importance of business services and outsourcing.

Enterprises are realising the expanding role of Business Services.

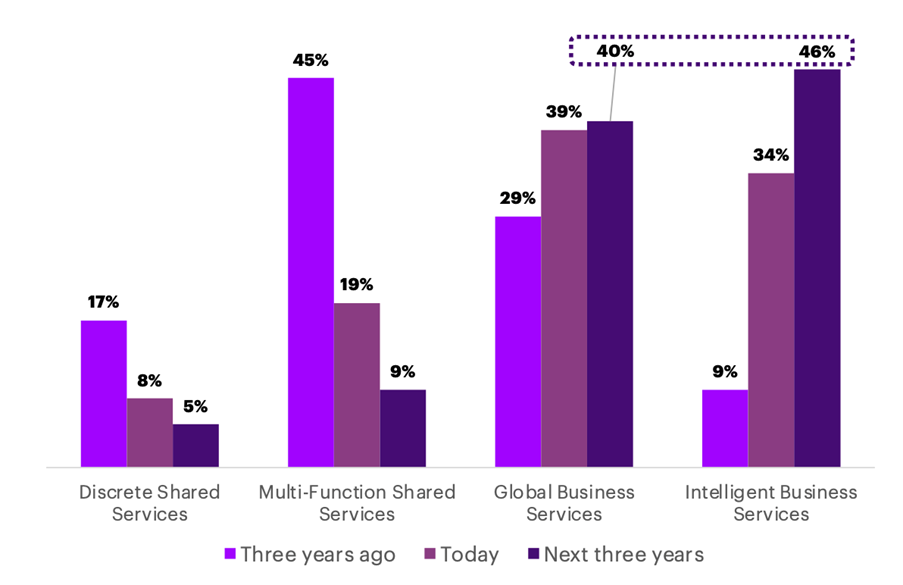

More than 160 companies with revenue of USD 3bn+ (86% of 200+) surveyed by Accenture are expected to mature to a Global Business Services (GBS) or Intelligent Business Services (IBS) model in the next 3 years. These are preferably outsourced but also self-run.

IBS is where the business can derive maximum benefits from a truly multifunctional outsourced service with global governance on end-to-end processes and singular data sources spanning the organisation, making data errors and lags, minimal.

An effective and efficient IBS would necessarily be on the Cloud, driving sustainability for self and the business and also be a change agent for continuing business transformation.

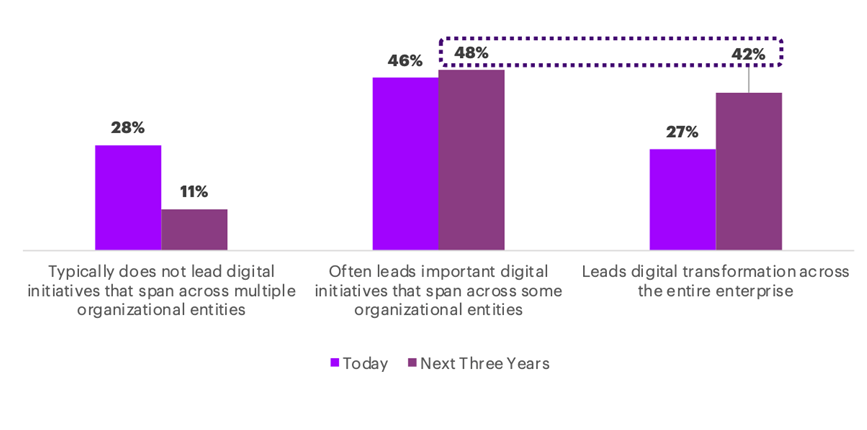

90% of the companies surveyed are expected to lead Digital Transformation efforts in the coming 3 years.

Digital transformation will pan from point automations to global cloud deployments of ERPs with varied systems of engagement deployed per need, ranging from custom-built solutions by service providers to those customised for specialised digital product companies.

Specialised intelligent systems built into the deployments and beyond will keep learning at speed on usage demographics, inputs to persona and other measurement metrics.

Service providers enabling outsourcing for these companies need to embrace these requirements in spirit and prepare further when in the long run, better-refined use cases of quantum computing will help predict exceptions at a much cheaper run cost/execute cycle, so these can be fed back into the learning systems enabling further agility.

The future belongs to those that adapt to this change rapidly.

Hear Pavan Pamidimarri, SVP, Finance Operations & Sourcing at Levi Strauss & Co in conversation with Sashi Narahari, Founder & CEO of HighRadius as they discuss why working and operating models need to continuously evolve, the impact of automatisation and AI on the GBS industry for next years and how GBS organisations stay up to date.

Indian Tiffin’s Editorial team also refers BDO in India and its associates, partners, employees, advisors and assigns

Engaging the international palate for over 6 years with exclusive stories, economic trends, and pertinent themes from India

BDO India introduced the Indian Tiffin in 2015 with an aim to provide international audiences, insights into key economic variables and themes trending in India.

Having completed 6 successful years, with fantastically encouraging feedback from readers, we are delighted to re-introduce the Indian Tiffin with a digital refresh.

Anchored on the concept of The Indian ‘Dabbawala’ legacy (accurate, efficient, and timely delivery) each edition of the Indian Tiffin, endeavours to bring forth the right blend of information, significant for cross-border business considerations, enabling informed decision making.

LOADING