With the country reeling under the COVID-19 pandemic, the Indian government has taken several measures to curb the spread of disease, revive economy, ease compliances, etc. On the tax front, since the Parliament was not in session and in light of the urgency, the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 (‘Ordinance 2020’) was promulgated on 31 March, 2020 which, inter alia, extended compliance timelines as well relaxed certain provisions of the specified Acts relating to Direct taxes, Indirect taxes and Prohibition of Benami Property transactions. Subsequently, various notifications and press releases were issued by the Central Board of Direct Taxes (‘CBDT’) to grant further relaxations in the some of the provisions of the Income-tax Act, 1961 (IT Act). Recently, The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bills, 2020 (‘the Bill’) was introduced to repeal the Ordinance 2020. The Bill also proposes to make amendments in the IT Act, Finance Act, 2020 (‘FA 2020’), the Direct Tax Vivad se Vishwas Act, 2020, etc. The Bill has been passed by the Lok Sabha and is now pending passage by Rajya Sabha and President’s assent.

We, at BDO in India, have analysed and summarised hereunder the key amendments proposed by the Bill:

1. Relaxation of various deadlines

The Bill proposes to consolidate and codify the following:

- Ordinance, 2020;[1]

- Notification No. 35/2020/ F. No. 370142/23/2020-TPL Dated 24 June 2020;[2]

- Notification No. 56/2020-Income Tax dated 29 July, 2020[3]

It is pertinent to note that the Bill provides no extension or relief in relation to timelines for various compliances (except for extending Commencement of Operation of Special Economic Zone to 31 March 2021) other than already provided earlier vide earlier Ordinance 2020 and notifications. These timelines from compliance perspective are as tabulated below:-

|

Particulars

|

Original due date

|

Due date as per the Ordinance 2020

|

Due date as per the Notification

|

Due date as per the Bill

|

|

Matters other than specifically provided:

- Completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action, by whatever name called, by any authority, commission or tribunal, by whatever name called, under the provisions of the specified Act; or

- filing of any appeal, reply or application or furnishing of any report, document, return, statement or such other record, by whatever name called, under the provisions of the specified Act

|

Deadline falling between 20 March 2020 and 31 December 2020

|

|

31 March 2021

|

31 March 2021

|

|

Tax return for fiscal year (FY) 2018-19 (Belated/ Revised tax return)

|

31 March 2020

|

30 June 2020

|

30 September 2020[4]

|

30 September 2020

|

|

Tax return for FY 2019-20

|

31 July 2020; or

31 October 2020; or

30 November 2020

|

30 November 2020[5]

|

30 November 2020

|

30 November 2020

|

|

e-TDS and e-TCS return for Quarter 4 of FY 2019-20

|

31 May 2020

|

30 June 2020

|

31 July 2020

|

31 July 2020

|

|

Issuance of Salary Certificate (i.e. Form 16) for FY 2019-20

|

15 June 2020

|

30 June 2020

|

15 August 2020

|

15 August 2020

|

|

Issuance of TDS Certificates (i.e. Form 16A) for FY 2019-20

|

15 June 2020

|

15 July 2020

|

15 August 2020

|

15 August 2020

|

|

Deduction under section 54 to 54GB of the IT Act

|

Due dates as per IT Act

|

30 June 2020

|

30 September 2020

|

30 September 2020

|

|

Deduction under any provisions of Chapter VI-A under the heading “B-Deductions in respect of certain payments”

|

Due dates as per IT Act

|

30 June 2020

|

31 July 2020

|

31 July 2020

|

|

Date of furnishing tax audit report for FY 20/19-20

|

30 September 2020; or

31 October 2020 (where TP is involved)

|

31 October 2020[6]

|

31 October 2020

|

31 October 2020

|

|

Commencement of Operation for Special Economic Zone units under section 10AA of the IT Act

|

31 March 2020

|

30 June 2020

|

30 September 2020

|

31 March 2021

|

|

Payment under Vivad se Vishwas Act, 2020*

|

31 March 2020

|

30 June 2020

|

31 December 2020

|

31 December 2020

|

*Payments made under the second tranche from 1 January 2021 onwards shall be subject to additional 10% of the amount payable. It is pertinent to note that the last date for availing the benefit is not proposed in the Bill.

2. Changes to Tax Residency Rules for Non-Residents

a. Clarification on deemed residency condition

With an intent to bring stateless persons within the ambit of tax and thereby curb double non taxation, Finance Act, 2020 introduced Section 6(1A) to the IT Act. As per this section, the residential status of an Indian citizen would be deemed to be ‘resident in India’, if such individual’s total income (excluding foreign sources income) exceeds INR 1.5mn and he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.

The Bill now proposes to clarify that the deemed residency condition, as contained in section 6(1A) of the IT Act, shall not apply to individuals who are said to be ‘resident in India’ under section 6(1) of the IT Act.

b. Definition of foreign source income

Finance Act, 2020 inserted definition of “income from foreign sources” to mean income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India).

The Bill now proposes to amend this definition to provide that the income from foreign sources shall not include incomes which are deemed to accrue or arise in India.

These amendments shall be made effective from 01 April 2021

3. Tax withholding rate as well as tax collected at source rate reduced

The press release dated 13 May 2020[7] doling out the economic stimulus package, had provided for reduced tax withholding rates. As per the release, the tax withholding rate were slashed by 25%. This press release was to be followed by a notification, which is still awaited. The Bill now proposes to introduce a new section in the IT Act to provide that the tax withholding rate as prescribed in the various sections[8] of the IT Act should be reduced by 25%.

This reduction is proposed to be effective from 14 May 2020 to 31 March 2021.

4. Income earned by specified funds in International Financial Services Centre (‘IFSC’)

a. Expanding the ambit of exempt income

The current provisions of IT Act exempt income from transfer of capital asset, being certain bonds, global depository receipts, rupee denominated bonds of Indian company or derivatives earned by ‘Specified Funds’. The Specified Funds are defined as ‘Category III Alternative Investment Funds’ located in IFSC, wherein all units (other than units held by sponsor or manager) are held by non-residents and derive its underlying income solely in convertible foreign exchange.

The Bill proposes to extend such exemption to the following incomes earned by Specified Funds:

- Income from transfer of securities (other than shares in a company resident in India);

- Income from securities issued by a non-resident (other than a permanent establishment of a non-resident in India) and where such income otherwise does not accrue or arise in India;

- Income from securitisation trust which is chargeable under the head Business and Profession.

The above exemptions are available to the extent such income attributable to units held by non-resident (not being the permanent establishment of a non-resident in India) and computed in the prescribed manner.

b. Exemption in the hands of unit holder

The Bill proposes to provide for exemption of any income accruing or arising or received by a unit holder from Specified Funds aforesaid. The Bill also proposes to exempt income arising to the unitholder from transfer of units of Specified Funds.

c. Exemption from applicability of Alternate Minimum Tax provision

Alternate Minimum Tax (‘AMT’) provisions are applicable to every taxpayer (other than Corporate taxpayer) if the tax under normal provision is less than 18.5% of adjusted total income. The Bill proposes to exempt Specified Funds from the applicability of AMT provisions.

d. Special tax rates

The Bill proposes to extend the beneficial tax regime currently available to Foreign Portfolio Investors to Specified Funds. The tax rates as applicable to Specified Funds under this regime are tabulated hereunder:

|

Nature of income

|

Tax Rate*

|

|

Income in respect of securities#

|

10%

|

|

Short term capital gains from specified equity shares/instruments (Section 111A of the IT Act)

|

15%

|

|

Short term capital gains from other securities

|

30%

|

|

Long term capital gains from securities

|

10%

|

*excluding surcharge and education cess

# other than units referred to in section 115AB of the IT Act.

The above tax rates will apply only to income attributable to units held by non-residents (not being the permanent establishment of a non-resident in India) computed in the prescribed manner.

These proposals will apply from fiscal year 2020-21 onwards.

e. Withholding of tax on income from securities

The Bill proposes to cast responsibility on the person making payment towards income from securities (other than capital gains arising from transfer of securities) to the Specified Funds, to withhold tax at the rate of 10%. However, the tax withholding is not required in respect of exempt income.

This amendment shall be made effective from 01 November 2020.

5. Surcharge on Dividend Income of Foreign Portfolio Investors

The Finance Act 2020 abolished Dividend Distribution Tax regime. With this, the dividend distributed and paid by domestic companies to both resident and non-resident shareholders are now subject to tax withholding. Further, as a measure of relief, the higher surcharge rate of 37% was restricted to 15%. However, inadvertently, this benefit of restricted surcharge rate of 15% was not passed on to certain non-resident shareholders like foreign portfolio investors (FPIs), Category I/II Alternate investment funds, etc.

The Bill now proposes to extend the restricted rate of surcharge of 15% to FPIs (being individuals, Hindu Undivided Family, Association of Person, Body of Individuals or Artificial Juridical Persons). The revised surcharge rate for dividend income is tabulated hereunder:

|

Income

|

Surcharge

|

|

Up to INR 05mn

|

No Surcharge

|

|

Above INR 05mn up to INR 10mn

|

10%

|

|

Above INR 10mn

|

15%

|

This amendment shall be made effective from fiscal year 2020-21.

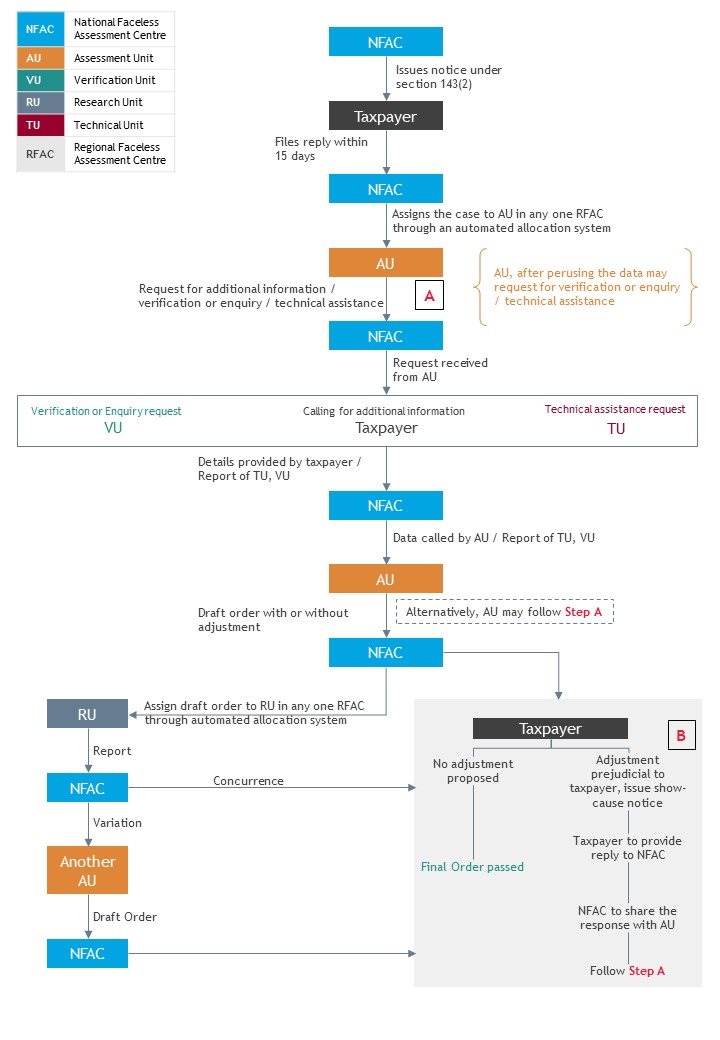

6. Faceless Assessment Scheme

Hon’ble Prime Minister of India announced Faceless Assessment Scheme[9] in August 2020. Pursuant to this announcement, CBDT issued notifications[10], to make amendments in the e-Assessment Scheme, 2019 as well as renaming it to Faceless Assessment Scheme, 2019. Additionally, the CBDT issued orders[11] to give clarity on some of the pertinent matters.

The Bill now proposes to codify Faceless Assessment Scheme by inserting as well as amending various sections in the IT Act. The Bill also proposes to empower the Central Government to make additional scheme(s), by notification in Official Gazette, so as to impart greater efficiency, transparency and accountability in various proceedings under the IT Act by:

- Eliminating interface between tax authority and the taxpayer/any other person to the extent technologically feasible

- Optimising utilisation of the resource through economies of scale and functional specialisation

- Introducing a team-based exercise

Further, the Bill proposes to confer powers on the Central Government to direct that any of the provisions of IT Act shall not apply or shall apply with such exceptions, modifications and adaptations as may be specified in the notification. However, no such direction can be issued post 31 March 2022. Further, it is also proposed that such notification shall be laid before both the Houses of Parliament.

The sections which are proposed to be amended / inserted by the Bill are tabulated hereunder:

The below amendments shall be effective from 01 November 2020

|

Sr. No.

|

Section reference

|

Section Heading

|

The Central Government may make a Scheme for the purposes

|

|

1.

|

Section 130

|

Faceless jurisdiction of the Tax Authorities

|

- Exercise of powers and performance of the functions conferred on or assigned to tax authorities as referred to in section 120 of the IT Act (i.e. jurisdiction of tax authorities); or

- Vesting the jurisdiction with the Tax Officer as referred to in section 124 of the IT Act (i.e. jurisdiction of tax officer); or

- Exercise of power to transfer cases under section 127 of the IT Act (i.e. power to transfer cases); or

- Exercise of jurisdiction in case of change of incumbency as referred to in section 129 of the IT Act (i.e. Change of incumbent of an office.

|

|

2.

|

Section 135A

|

Faceless Collection of Information

|

- Calling for information under section 133 of the IT Act; or

- Collecting information under section 133B of the IT Act; or

- Calling for information by prescribed tax authority under section 133C of the IT Act; or

- Exercise of power to inspect register of companies under section 134 of the IT Act; or

- Exercise of power of Tax Officer under section 135 of the IT Act.

|

|

3.

|

Section 142B

|

Faceless inquiry or Valuation

|

- Issuing notice under 142(1) of the IT Act (i.e. notice to call for information /file the tax return); or

- Making inquiry before assessment under section 142(2) of the IT Act; or

- Directing the taxpayer to get his accounts audited under section 142(2A) of the IT Act; or

- Estimating the value of any asset, property or investment by a Valuation Officer under section 142A of the IT Act.

|

|

4.

|

Section 92CA(8)

|

Reference to Transfer Pricing Officer

|

Reference to the Transfer Pricing Officer for the determination of arm’s length price

|

|

5.

|

Section 144C(14B)

|

Proceedings before Dispute Resolution Panel

|

Issuance of directions by the Dispute Resolution Panel

|

|

6.

|

Section 151A

|

Faceless Assessment of income escaping assessment

|

- Assessment, reassessment or re-computation under section 147 of the IT Act; or

- Issuance of notice under section 148 of the IT Act (i.e. reassessment notice); or

- Sanction for issue of such notice under section 151 of the IT Act.

|

|

7.

|

Section 157A

|

Faceless rectification, amendments and issuance of demand notice or intimation

|

- Rectification of any mistake apparent from record under section 154 of the IT Act; or

- Other amendments under section 155; or

- Issue of notice of demand under section 156 of the IT Act; or

- Intimation of loss under section 157 of the IT Act.

|

|

8.

|

Section 231

|

Faceless collection and recovery of tax

|

- Issuance of lower tax withholding certificate under section 197 of the IT Act;

- Deeming a person to be an assessee in default under section 201(1) or section 206C(6A) of the IT Act (i.e. failure to deduct / collect or pay tax);

- Issuance of certificate for lower collection of tax under section 206C (9) of the IT Act;

- Passing of order or amended order (in relation to advance tax) under section 210(3) or section 210(4) of the IT Act; or

- Reduction or waiver of the amount of interest paid or payable by the taxpayer under section 220(2A) of the IT Act; or

- Extending the time for payment or allowing payment by instalment under section 220(3),

and various other proceedings[12]

|

|

9.

|

Section 253(8)

|

Appeal proceedings before Tax Tribunal

|

Appeal before the Tax Tribunal

|

|

10.

|

Section 264A

|

Faceless revision of orders

|

Revision of orders under section 263 or section 264 of the IT Act

|

|

11.

|

Section 264B

|

Faceless effect of orders

|

Giving effect to an order under section 250 (i.e. procedure in appeal), section 254 (i.e. orders of Appellate Tribunal), section 260 (i.e. High Court and Supreme Court decision), section 262 (i.e. hearing before Supreme Court), section 263 (i.e. revisional orders prejudicial to revenue) or section 264 (i.e. revision of orders) of the IT Act

|

|

12.

|

Section 279(4)

|

Prosecution and compounding proceedings

|

Granting sanction for initiation of prosecution or compounding of any offense under the IT Act

|

|

13.

|

Section 293D

|

Faceless approval or registration

|

Granting approval or registration by the tax authority under any provision of the Act

|

The below amendments shall be effective from 01 April 2021

|

Sr. No.

|

Section reference

|

Section Heading

|

Brief Description

|

|

1.

|

Section 143

|

|

The Scheme made under section 143(3A) of the IT Act shall apply to the assessment made under section 143(3) or section 144 of the IT Act on or after 1 April 2021

|

|

2.

|

Section 144B

|

Faceless assessment procedure

|

Please refer below for the process flow of faceless assessment procedure

|

|

| a. |

Where the taxpayer has:

- Filed the return under section 139 or section 142(1) or section 148(1) and notice is issued under section 143(2) of the IT; or

- Not furnished the return in response to 142(1) of the IT Act; or

- Not furnished the return under section 148(1) of the IT Act and a notice under section 142(1) of the IT Act is issued

The NFAC shall intimate the taxpayer that the assessment shall be completed in Faceless manner.

|

| b. |

If a taxpayer does not respond to the notice issued by NFAC, the AU will pass best judgement assessment under section 144 of the IT Act. NFAC will follow Step B before passing the final order.

|

| c. |

Once the assessment is finalised, the tax officer to serve order and notice for initiating penalty proceedings, if any, to the taxpayer, alongwith the demand notice, specifying the sum payable by, or refund of any amount due to, the taxpayer on the basis of such assessment.

|

| d. |

Where the NFAC passes order as per section 144C(2) of the IT Act, the taxpayer has an option to file an objection before the Dispute Resolution Panel. In such instance, NFAC shall, upon receipt of directions from DRP, forward such directions to the concerned AU. The AU shall then, in conformity of the DRP directions, send the copy of the order to NFAC. NFAC in-turn to finalise the assessment and serve a copy of the order along with demand notice.

|

| e. |

Post the assessment, NFAC shall transfer all the electronic records of the case to the Tax Officer having jurisdiction over the said case for such action as may be required under the IT Act.

|

7. Exemption to Wholly Owned Subsidiary (‘WOS’) of Abu Dhabi Investment Authority (‘ADIA’) in respect of investment income

In order to promote investment in India by sovereign bodies, Finance Act, 2020 inserted a section 10(23FE) to provide exemption from interest, dividend and capital gains arising from investment in India by the following specified persons:

- WOS of ADIA which is resident of United Arab Emirates; and

- Sovereign Wealth Funds, fulfilling certain conditions.

The exemption is available in respect of debt and equity investment made on or before 31 March 2024 and held for minimum period of 3 years in a company or enterprise carrying on the business of developing, operating and maintaining, or developing, operating of maintaining any infrastructure facility as defined under section 80 IA of the IT Act.

The Bill has now proposed to amend section 10(23FE) of the IT Act to provide that exemption in respect of WOS of ADIA shall be available only if such WOS is a tax resident of Abu Dhabi.

This amendment shall be made effective from fiscal year 2020-21

8. Deduction under section 80G of the IT Act

The Bill has proposed to amend section 80G(2) of the IT Act to provide that the donations made to Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES FUND) will be entitle for 100% deduction under section 80G.

This amendment shall be made effective from fiscal year 2019-20.

BDO Comments

The Indian government has been undertaking various steps to mitigate the challenges posed by COVID-19. The Bill consolidates most of the announcements made by the government. In May 2020, when the reduction in tax withholding rates was announced, the notification was soon expected. However, no such notification was issued till the introduction of the Bill. By incorporating the rate reduction in the Bill itself and making it effective retrospectively, it would give much relief as the taxpayers may have started withholding tax at the reduced rate. Also, in cases of deemed resident in India, towards computing ‘income from foreign sources’, several representations were made by various stakeholders on the income inclusion / exclusion. The Bill now proposes to exclude the incomes which are deemed to accrue or arise in India from the purview of ‘income from foreign sources’ which brings much needed clarity on this aspect. Further, by codifying the Faceless Assessment Scheme, it is ensured that for making any changes in the Faceless Assessment Scheme approval of both the Houses is necessary.

[4] Notification No. 56/2020-Income Tax dated 29 July 2020 further extended the due date to 30 September 2020

[5] Press Release dated 13 May 2020, the deadline for filing tax return by all taxpayer has been extended to 30 November 2020

[6] Press Release dated 13 May 2020, the deadline for filing tax return by all taxpayer has been extended to 30 November 2020

[8] Section 193, section 194, section 194A, section 194C, section 194D, section 194DA, section 194EE, section 194F, section 194G, section 194H, section 194-I, section 194-IA, section 194-IB, section 194-IC, section 194J, section 194K, section 194LA, section 194LBA(1), section 194LBB(i), section 194LBC(1), sections 194M and 194-O, section 206C(1) (Certain exception mentioned), section 206C(1F) or section 206C(1H) of the IT Act

[10] Notification No. 60/2020/F.No. 370149/154/2019-TPL and Notification No. 61/2020/F.No. 370149/154/2019-TPL dated 13 August 2020

[11] F.No. 187/3/2020-ITA-1 dated 13 August 2020

[12] treating the taxpayer as not being in default under section 220(6) or section 220(7) of the IT Act, or levy of penalty under section 221 of the IT Act, or drawing of certificate by the Tax Recovery Officer under section 222, or jurisdiction of Tax Recovery Officer under section 223, or stay of proceedings in pursuance of certificate and amendment or cancellation thereof by the Tax Recovery Officer under section 225, or other modes of recovery under section 226 or issuance of tax clearance certificate under section 230 of the IT Act